Why Virtual Bookkeeping is a Game-Changer for Small Businesses

Struggling to keep up with your books while running your business? This post explores how virtual bookkeeping can save you time, reduce costs, and give you real-time financial clarity—without hiring in-house staff. Learn why it's the smarter choice for today’s small business owners.

5 min read

Why Virtual Bookkeeping is a Game-Changer for Small Businesses

As a small business owner, you've probably worn the accountant hat more times than you'd like. From sorting receipts and balancing ledgers to preparing for tax season, managing the books can become an overwhelming and time-consuming task. Financial management is essential to success, but that doesn't mean it needs to rest entirely on your shoulders.

What if you could hand it off—without hiring an in-house accountant or expanding your payroll? That’s where virtual bookkeeping comes in. This modern, tech-driven solution is transforming the way entrepreneurs like you handle finances. Let’s explore how virtual bookkeeping can lighten your load, sharpen your financial visibility, and ultimately fuel your business growth.

What Exactly Is Virtual Bookkeeping?

Virtual bookkeeping is the process of managing your financial records remotely. Instead of hiring an on-site bookkeeper or doing everything yourself, you work with a professional who handles your books online using cloud-based software like QuickBooks, Xero, or FreshBooks.

Transactions, receipts, invoices, payroll, and reconciliations are all managed securely through cloud platforms, giving you and your bookkeeper access to real-time data anytime, anywhere. With bank feeds, digital receipts, and automated categorization, many manual tasks are simplified or eliminated altogether.

Unlike traditional bookkeeping, virtual bookkeeping doesn't require office space, full-time salaries, or in-person meetings. It's a leaner, more agile solution that keeps up with how modern small businesses operate.

5 Reasons Small Businesses Are Switching to Virtual Bookkeeping

If you're still using spreadsheets or trying to juggle receipts in a shoebox, it might be time for a smarter solution. Here are five powerful reasons small business owners are moving to virtual bookkeeping:

1. It Saves You Time and Money

Time is one of your most precious resources. Virtual bookkeeping automates tedious tasks and keeps your records organized, so you spend less time on data entry and more time running your business. It also saves money by eliminating the need for a full-time employee, office space, or benefits package.

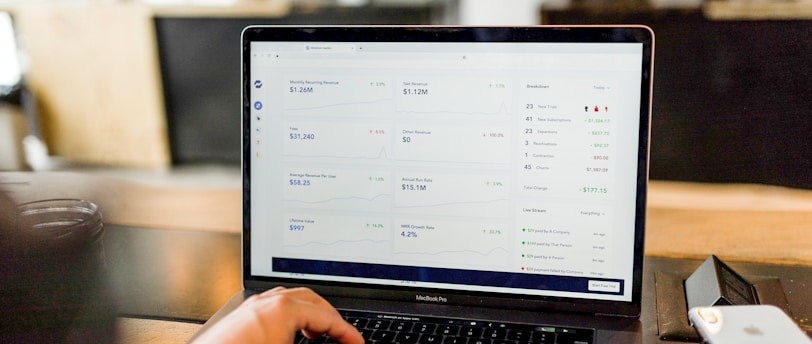

2. You Get Real-Time Financial Insight

Need to know your profit margins or cash flow at a glance? Cloud-based bookkeeping tools provide instant access to up-to-date financial data. This real-time visibility helps you make informed decisions on spending, hiring, inventory, and growth.

3. It Reduces Human Error

Let’s face it: when you're rushing to enter transactions after a long day, mistakes happen. Virtual bookkeeping systems automate much of the process, reducing the risk of errors in categorization, calculations, or data entry.

4. You’re Ready for Tax Season—Always

Say goodbye to the year-end scramble. With virtual bookkeeping, your records stay updated throughout the year, and everything is categorized, reconciled, and ready to go when it’s time to file taxes.

5. It Scales With Your Business

Whether you're a solopreneur or have a growing team, virtual bookkeeping services can grow with you. Need payroll support? Inventory tracking? Multi-account reconciliation? Your virtual bookkeeper can handle it—without you needing to rebuild your back office.

How to Know If It’s Time to Hire a Virtual Bookkeeper

Still not sure if you need one? Here are common signs that a virtual bookkeeper might be just what your business needs:

You’re behind on your bookkeeping. It’s been weeks (or months) since you updated your books, and you dread catching up.

You’re doing it yourself—and you hate it. DIY may have worked early on, but now it’s eating into your time and causing stress.

You’re missing deductions and write-offs. Without accurate records, you could be leaving money on the table at tax time.

You can’t make confident financial decisions. If you’re guessing about your cash flow or margins, you’re flying blind.

You’re preparing for growth. New locations, products, or employees require sharper financial systems and scalable solutions.

Virtual bookkeeping isn’t just for businesses in trouble—it’s a strategic move for companies looking to operate smarter.

Choosing the Right Virtual Bookkeeping Partner

Not all virtual bookkeeping services are created equal. Here’s what to look for when selecting the right partner:

1. Experience with Small Businesses

Find a bookkeeper who understands the unique challenges of small business operations—not just someone who works with corporate enterprises.

2. Familiarity with Leading Software

Your bookkeeper should be well-versed in platforms like QuickBooks Online, Xero, or FreshBooks. Bonus points if they help you choose the best one for your business.

3. Clear Communication

Since this is a remote relationship, responsiveness and communication are key. Look for someone who provides regular updates, financial reports, and is available for questions.

4. Secure, Transparent Practices

They should use bank-level security protocols and be transparent about how your financial data is accessed and protected.

5. Customizable Services

Whether you need help with invoicing, payroll, budgeting, or tax prep, your bookkeeper should offer flexible plans that grow with your business.

Ready to Hand Off Your Books? Let’s Talk.

Financial clarity isn’t a luxury—it’s a necessity for growth. If you’re spending too much time on spreadsheets, losing track of expenses, or simply want peace of mind that your books are in good hands, virtual bookkeeping is the solution you didn’t know you needed.

At Resilient Business Solutions, we specialize in helping small business owners get organized, gain financial visibility, and reclaim their time. We offer flexible virtual bookkeeping plans designed to meet you where you are and scale as you grow.

Let’s talk about how we can support your business. Book a free consultation today and see the difference a dedicated financial partner can make.

Explore our Bookkeeping Services

FAQ: Virtual Bookkeeping for Small Businesses

Q: Is virtual bookkeeping safe?

A: Yes. When using secure cloud software, your financial data is encrypted, backed up, and accessible only to authorized users.

Q: How much does virtual bookkeeping cost?

A: Costs vary based on your needs, but it's almost always much more affordable than hiring a full-time in-house bookkeeper.

Q: Will I lose control of my finances?

A: Not at all. Virtual bookkeeping gives you more control, not less—you’ll always have access to your financial data in real time.

Q: Can a virtual bookkeeper help with taxes?

A: Yes. While not all bookkeepers are tax preparers, many work directly with your CPA and ensure your books are ready for filing.

Q: Do I need to switch software?

A: Not necessarily. A good virtual bookkeeper will work with your existing system or help you migrate if a better option exists.

Need help deciding? We’re happy to answer your questions and walk you through your options.

When You Are Ready

Ready to simplify your business operations? At Resilient Business Solutions, we’re here to take the stress out of so many of your business tasks, so you can focus on what you do best — growing your business. Whether you need help with bookkeeping, invoicing, managing payables and receivables, content creation, or a new website design, we’ve got you covered. Contact us today to learn how we can support your business with reliable, expert services. Let’s build a resilient future together!

Strengthening Your Bottom Line

Customized financial support to empower your business success.

Get Our Free 50+ Page Small Business Success Guide Now

© 2024. All rights reserved.